The challenges of banks migration to the ISO 20022 standard

ISO 20022 is an international standard based on XML (eXtensible Markup Language) messages used for financial data exchanges (payments, direct debits, etc.) between companies and banks, and also between financial institutions.

In Europe, the Single Euro Payments Area (SEPA) is already based on this standard. Gradually, the ISO 20022 standard is becoming more generalized to offer a common and global standard to companies and financial institutions.

In this context, SWIFT requested banks to adopt ISO 20022 by November 2025 for cross-border interbank exchanges (international credit transfers) on the SWIFT network and for large-value transfers.

What are the benefits for companies?

The generalized adoption of the ISO 20022 standard by all the market players offers real benefits for companies, such as:

- Elimination of file conversion steps by banks in the inter-bank process and therefore the potential loss of data

- More accurate accounting reconciliation and payment tracking with commercial and customer reference data throughout the payment chain

- Transparency on fee and regulatory information

- Automated payment processing with less back-office intervention, resulting in faster payment execution and fewer errors

What are the impacts for companies?

Banks will not be able to impose the standard change on companies. They will have to use a converter to transform companies’ files from SWIFT MT101 or CFONB 320 (French standard for international transfers) to ISO 20022. However, companies are well advised to migrate their payment flows to ISO 20022 to benefit from the richness of the payment information.

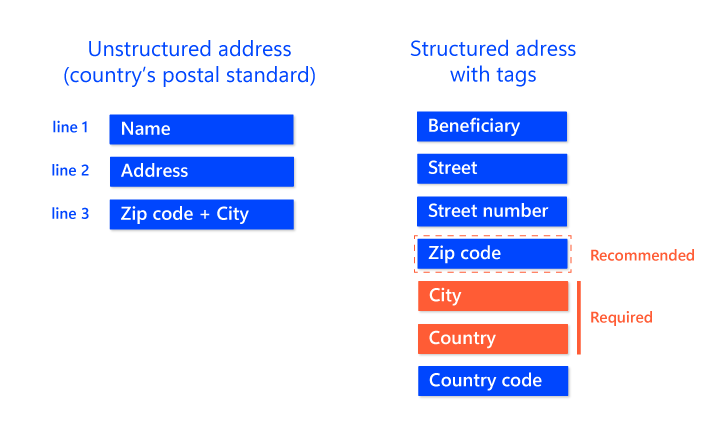

For companies that already send international payments to their banks with the ISO 20022 standard, they will have to use a structured postal address for senders and beneficiaries with fields dedicated to the city, postal code and country, starting in March 2023, start of the migration (initially scheduled for November 2022, but delayed by SWIFT) and before November 2025. This standardization is intended to make filtering operations by banks more efficient and to fight against money laundering and terrorist financing. Companies will therefore have to structure this data for their suppliers within their ERP and payment and cash management applications.

The Cegid Allmybanks software is already ISO 20022 ready with structured addresses for senders and beneficiaries! Cegid Allmybanks can connect to any bank in the world thanks to its connector to the SWIFT network.